What Is a Stock?

A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation. Corporations issue (sell) stock to raise funds to operate their businesses. There are two main types of stock: common and preferred. Common stock usually entitles the owner to vote at shareholders' meetings and to receive any dividends paid out by the corporation. Preferred stockholders generally do not have voting rights, though they have a higher claim on assets and earnings than the common stockholders. For example, owners of preferred stock receive dividends before common shareholders and have priority in the event that a company goes bankrupt and is liquidated. Stock holders do not own corporations; they own shares issued by corporations.

A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation. Corporations issue (sell) stock to raise funds to operate their businesses. There are two main types of stock: common and preferred. Common stock usually entitles the owner to vote at shareholders' meetings and to receive any dividends paid out by the corporation. Preferred stockholders generally do not have voting rights, though they have a higher claim on assets and earnings than the common stockholders. For example, owners of preferred stock receive dividends before common shareholders and have priority in the event that a company goes bankrupt and is liquidated. Stock holders do not own corporations; they own shares issued by corporations.

ST

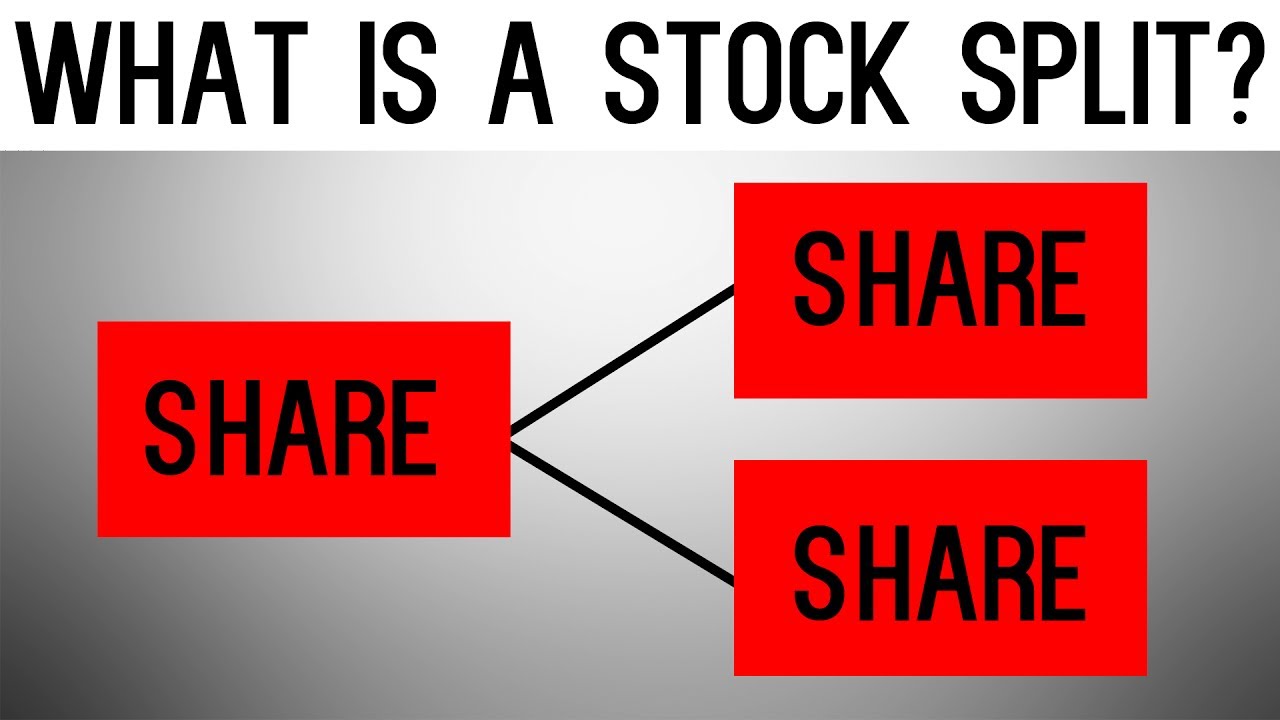

What Is a Share?

A share refers to the stock certificate of a particular company. A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares. Holding a particular company's share makes you a shareholder.

So if someone says she "owns shares," some people's inclination would be to respond, "shares in what company?". Similarly, an investor might tell his broker to buy him 100 shares of Google. If he said "buy 100 stocks," he'd be referring to a whole collection of companies — 100 different ones, in fact.

A share refers to the stock certificate of a particular company. A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares. Holding a particular company's share makes you a shareholder.

So if someone says she "owns shares," some people's inclination would be to respond, "shares in what company?". Similarly, an investor might tell his broker to buy him 100 shares of Google. If he said "buy 100 stocks," he'd be referring to a whole collection of companies — 100 different ones, in fact.

ST

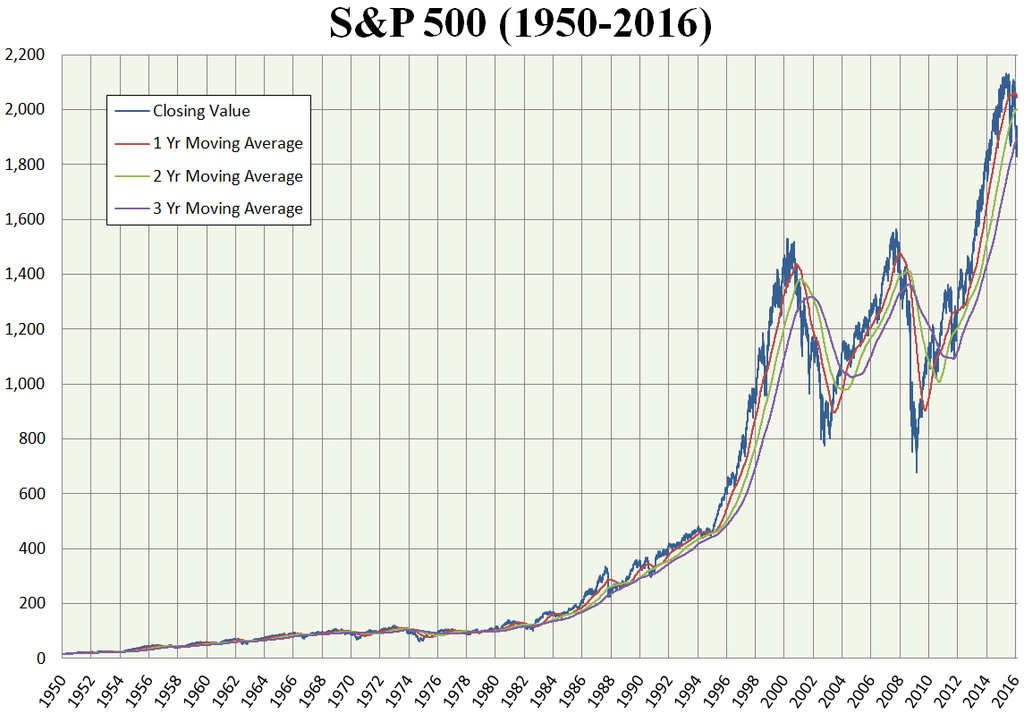

What Is The S&P 500?

The S&P 500 (Standard & Poor's 500) a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the US.

As of September 2018, the S&P 500 was divided into 11 sectors, as follows, with their respective weightings by market capitalization:

The S&P 500 (Standard & Poor's 500) a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the US.

As of September 2018, the S&P 500 was divided into 11 sectors, as follows, with their respective weightings by market capitalization:

- Communication Services: 9.9%

- Consumer Discretionary: 10.2%

- Consumer Staples: 6.7%

- Energy: 6.0%

- Financials: 13.7%

- Health Care: 14.9%

- Industrials: 9.7%

- Materials: 2.5%

- Real Estate: 2.7%

- Technology: 20.8%

- Utilities: 2.8%

ST

What Is an Audit?

A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent.

It is what the IRS issues when they coming for your ass.

A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent.

It is what the IRS issues when they coming for your ass.

AU

What Is Accounting?

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows.

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows.

AU

What Are Taxes?

Taxes are involuntary fees levied on individuals or corporations and enforced by a government entity—whether local, regional or national—in order to finance government activities.

Taxes are involuntary fees levied on individuals or corporations and enforced by a government entity—whether local, regional or national—in order to finance government activities.

AU

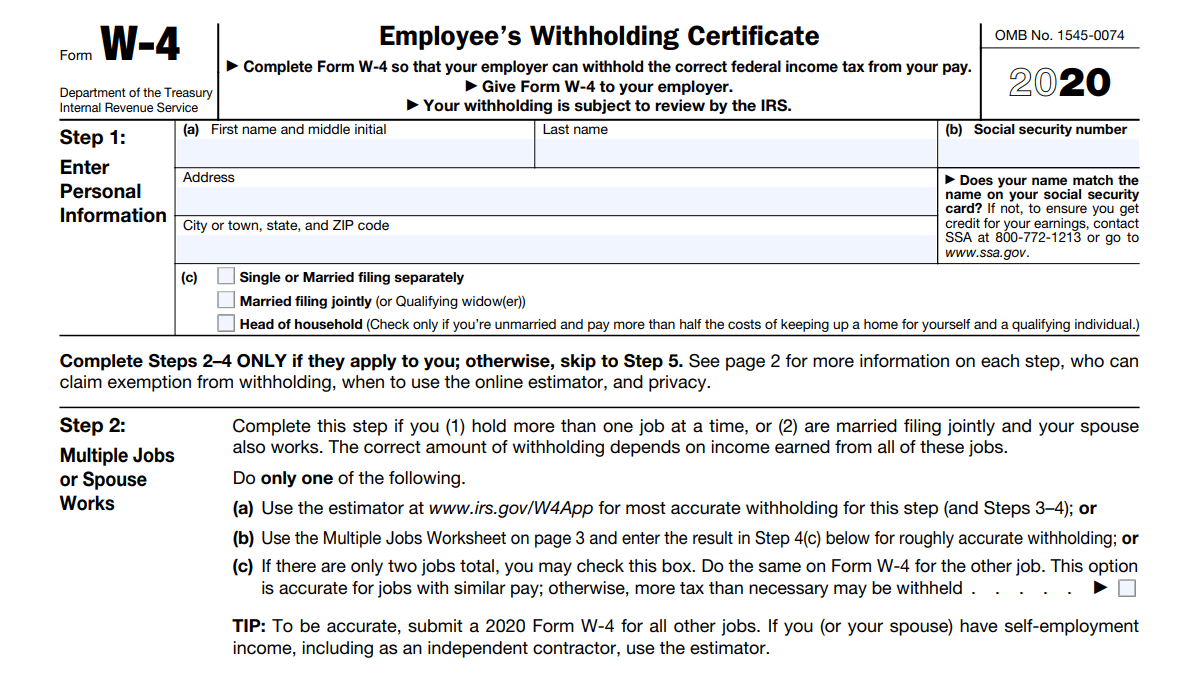

What Is a W-4 Form?

Form W-4 is an Internal Revenue Service tax form completed by an employee in the United States to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of tax to withhold from an employee's paycheck.

Form W-4 is an Internal Revenue Service tax form completed by an employee in the United States to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of tax to withhold from an employee's paycheck.

AU

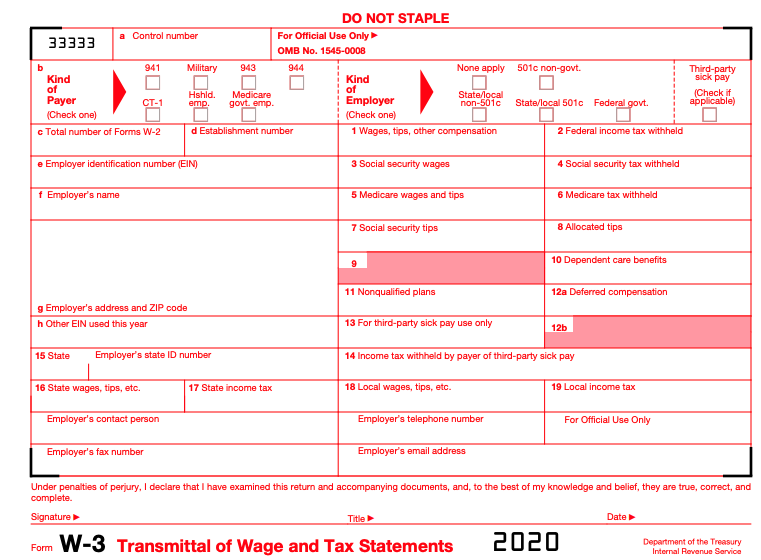

What Is a W-3 Form?

Form W-3 is a transmittal form with totals for all parts of Form W-2. The W-3, along with the W-2, is sent to Social Security Administration each year to show the total earnings for all W-2 forms. The official title of the form is "Transmittal of Wage and Tax Statements." The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3.

Form W-3 is a transmittal form with totals for all parts of Form W-2. The W-3, along with the W-2, is sent to Social Security Administration each year to show the total earnings for all W-2 forms. The official title of the form is "Transmittal of Wage and Tax Statements." The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3.

AU

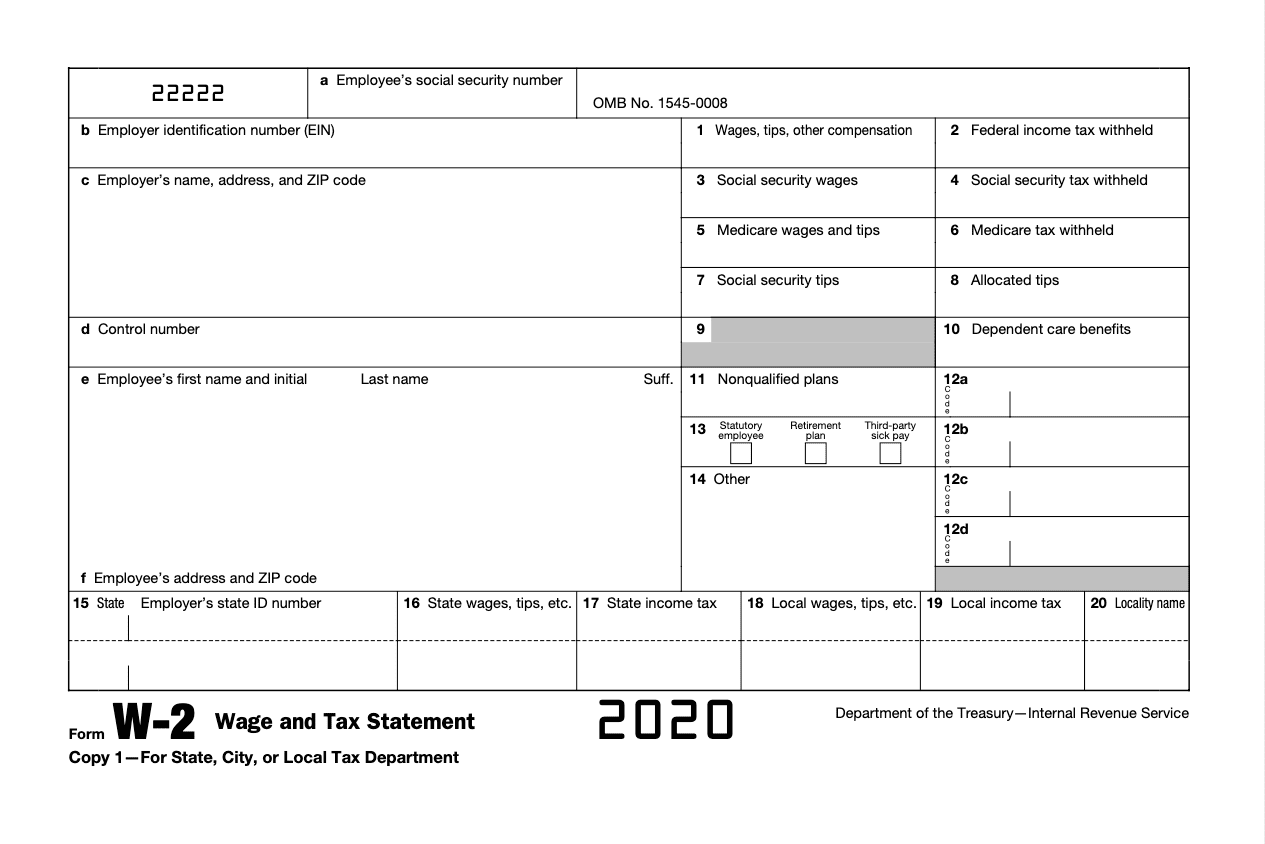

What Is a W-2 Form?

A W-2 form, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and to the Internal Revenue Service (IRS) at the end of the year. A W-2 reports the employee's annual wages and the amount of taxes withheld from their paychecks.

A W-2 form, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and to the Internal Revenue Service (IRS) at the end of the year. A W-2 reports the employee's annual wages and the amount of taxes withheld from their paychecks.

AU

What Is Trial Balance?

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues.

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues.

AU

What Is a Journal Entry?

In manual accounting or bookkeeping systems, business transactions are first recorded in a journal hence the term journal entry. Transactions are listed in an accounting journal that shows a company's debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit.

In manual accounting or bookkeeping systems, business transactions are first recorded in a journal hence the term journal entry. Transactions are listed in an accounting journal that shows a company's debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit.

AU

What Is The Double Entry System?

The double-entry system of accounting or bookkeeping means that for every business transaction, amounts must be recorded in a minimum of two accounts. It is a system of book keeping where every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system also requires that for all transactions, the amounts entered as debits must be equal to the amounts entered as credits. The double-entry has two equal and corresponding sides known as debit and credit. The left-hand side is debit and right-hand side is credit.

The double-entry system of accounting or bookkeeping means that for every business transaction, amounts must be recorded in a minimum of two accounts. It is a system of book keeping where every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system also requires that for all transactions, the amounts entered as debits must be equal to the amounts entered as credits. The double-entry has two equal and corresponding sides known as debit and credit. The left-hand side is debit and right-hand side is credit.

AU

What Is an Account?

In accounting, an account is a record in the general ledger that is used to sort and store transactions. For example, companies will have a Cash account in which to record every transaction that increases or decreases the company's cash. Another account, Sales, will collect all of the amounts from the sale of merchandise. Most accounting systems require that every transaction will affect two or more accounts. For example, a cash sale will increase the Cash account and will increase the Sales account.

In accounting, an account is a record in the general ledger that is used to sort and store transactions. For example, companies will have a Cash account in which to record every transaction that increases or decreases the company's cash. Another account, Sales, will collect all of the amounts from the sale of merchandise. Most accounting systems require that every transaction will affect two or more accounts. For example, a cash sale will increase the Cash account and will increase the Sales account.

AU

What Are The Types Of Accounts?

All accounts within the organization can be split into three types. An account can be of one and only one of the following type and not more. Here are the various types of accounts.

Personal: Personal accounts make most intuitive sense. We keep a track of all the transactions that we have undertaken with a particular person in them. We all maintain personal accounts like the money we owe our friends, the grocer and so on.

Real: Real accounts are accounts which have been created to account for tangible things. Accounts such as land and building, machinery a/c etc are called real accounts. Although they are not living beings, we still transact with such entities. Records of such transactions are kept in real accounts.

Nominal: Nominal accounts are a special category of accounts. While the other accounts can hold balance and carry it forward, nominal account are automatically reset to zero as soon as the time period is over. Their balance is carried forward to other accounts and the books for that period are closed. Examples of such accounts are Profit a/c, depreciation a/c etc.

All accounts within the organization can be split into three types. An account can be of one and only one of the following type and not more. Here are the various types of accounts.

Personal: Personal accounts make most intuitive sense. We keep a track of all the transactions that we have undertaken with a particular person in them. We all maintain personal accounts like the money we owe our friends, the grocer and so on.

Real: Real accounts are accounts which have been created to account for tangible things. Accounts such as land and building, machinery a/c etc are called real accounts. Although they are not living beings, we still transact with such entities. Records of such transactions are kept in real accounts.

Nominal: Nominal accounts are a special category of accounts. While the other accounts can hold balance and carry it forward, nominal account are automatically reset to zero as soon as the time period is over. Their balance is carried forward to other accounts and the books for that period are closed. Examples of such accounts are Profit a/c, depreciation a/c etc.

AU

What Are Three Golden Rules Of Accounting?

1. Debit The Receiver, Credit The Giver

This principle is used in the case of personal accounts. When a person gives something to the organization, it becomes an inflow and therefore the person must be credit in the books of accounts. The converse of this is also true, which is why the receiver needs to be debited.

2. Debit What Comes In, Credit What Goes Out

This principle is applied in case of real accounts. Real accounts involve machinery, land and building etc. They have a debit balance by default. Thus when you debit what comes in, you are adding to the existing account balance. This is exactly what needs to be done. Similarly when you credit what goes out, you are reducing the account balance when a tangible asset goes out of the organization.

3. Debit All Expenses And Losses, Credit All Incomes And Gains

This rule is applied when the account in question is a nominal account. The capital of the company is a liability. Therefore it has a default credit balance. When you credit all incomes and gains, you increase the capital and by debiting expenses and losses, you decrease the capital. This is exactly what needs to be done for the system to stay in balance.

The golden rules of accounting allow anyone to be a bookkeeper. They only need to understand the types of accounts and then diligently apply the rules.

1. Debit The Receiver, Credit The Giver

This principle is used in the case of personal accounts. When a person gives something to the organization, it becomes an inflow and therefore the person must be credit in the books of accounts. The converse of this is also true, which is why the receiver needs to be debited.

2. Debit What Comes In, Credit What Goes Out

This principle is applied in case of real accounts. Real accounts involve machinery, land and building etc. They have a debit balance by default. Thus when you debit what comes in, you are adding to the existing account balance. This is exactly what needs to be done. Similarly when you credit what goes out, you are reducing the account balance when a tangible asset goes out of the organization.

3. Debit All Expenses And Losses, Credit All Incomes And Gains

This rule is applied when the account in question is a nominal account. The capital of the company is a liability. Therefore it has a default credit balance. When you credit all incomes and gains, you increase the capital and by debiting expenses and losses, you decrease the capital. This is exactly what needs to be done for the system to stay in balance.

The golden rules of accounting allow anyone to be a bookkeeper. They only need to understand the types of accounts and then diligently apply the rules.

AU

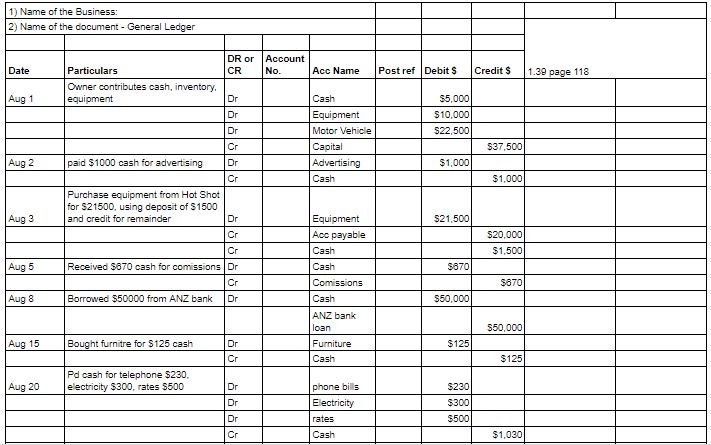

What Is a General Ledger?

A general ledger represents the record-keeping system for a company's financial data with debit and credit account records validated by a trial balance. The general ledger provides a record of each financial transaction that takes place during the life of an operating company.

The general ledger holds account information that is needed to prepare the company's financial statements, and transaction data is segregated by type into accounts for assets, liabilities, owners' equity, revenues, and expenses.

A general ledger represents the record-keeping system for a company's financial data with debit and credit account records validated by a trial balance. The general ledger provides a record of each financial transaction that takes place during the life of an operating company.

The general ledger holds account information that is needed to prepare the company's financial statements, and transaction data is segregated by type into accounts for assets, liabilities, owners' equity, revenues, and expenses.

AU

What Are Financial Statements?

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Financial statements include: Balance Sheets, Income Statements, & Cash Flow Statements.

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Financial statements include: Balance Sheets, Income Statements, & Cash Flow Statements.

AU

What Is an Accounts Receivable (AR)?

Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and/or services rendered that customers/clients have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. AR is any amount of money owed by customers for purchases made on credit.

Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and/or services rendered that customers/clients have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. AR is any amount of money owed by customers for purchases made on credit.

AU

What Is The VIX?

VIX is the ticker symbol created by the Chicago Board Options Exchange (CBOE). The Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

VIX is the ticker symbol created by the Chicago Board Options Exchange (CBOE). The Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

ST

What Is Forex?

Foreign Exchange (forex or FX) is the trading of one currency for another. For example, one can swap the U.S. dollar for the euro. Foreign exchange transactions can take place on the foreign exchange market, also known as the Forex Market.

Foreign Exchange (forex or FX) is the trading of one currency for another. For example, one can swap the U.S. dollar for the euro. Foreign exchange transactions can take place on the foreign exchange market, also known as the Forex Market.

FE

What Is The Foreign Exchange Market?

The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices.

The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices.

FE

What Is US30?

The Wall Street 30, also known as US30, Dow Jones 30, DJ30, or simply the Dow, is one of the most widely recognized stock market indices in the world. Historically, the index was created to track the movements of the largest industrial companies in America, however today it is comprised of thirty companies from all different sectors.

The index often faces criticism because it is a price-weighted average, which means a higher priced stock will have a greater influence over the index than those with a lower price and thus does not take into account percentage change. Additionally, many feel its inclusion of merely 30 stocks is not an accurate representation of the overall U.S. market performance. That being said, the companies it is comprised of are some of the largest household names not only in the United States, but also the world, such as Intel, Exxon Mobil and Goldman Sachs. This index is mainly traded through the foreign exchange market.

The Wall Street 30, also known as US30, Dow Jones 30, DJ30, or simply the Dow, is one of the most widely recognized stock market indices in the world. Historically, the index was created to track the movements of the largest industrial companies in America, however today it is comprised of thirty companies from all different sectors.

The index often faces criticism because it is a price-weighted average, which means a higher priced stock will have a greater influence over the index than those with a lower price and thus does not take into account percentage change. Additionally, many feel its inclusion of merely 30 stocks is not an accurate representation of the overall U.S. market performance. That being said, the companies it is comprised of are some of the largest household names not only in the United States, but also the world, such as Intel, Exxon Mobil and Goldman Sachs. This index is mainly traded through the foreign exchange market.

FE

What Economic Factors Affect The Forex Market?

Macroeconomic statistics, such as inflation, have the greatest impact on forex markets.

Stock, bond, commodity, and other capital markets also have a strong influence on exchange rates.

International trade numbers, such as trade deficits and surpluses, play a vital role in forex markets.

Political news can also be important for forex traders, especially when unexpected outcomes occur.

FE

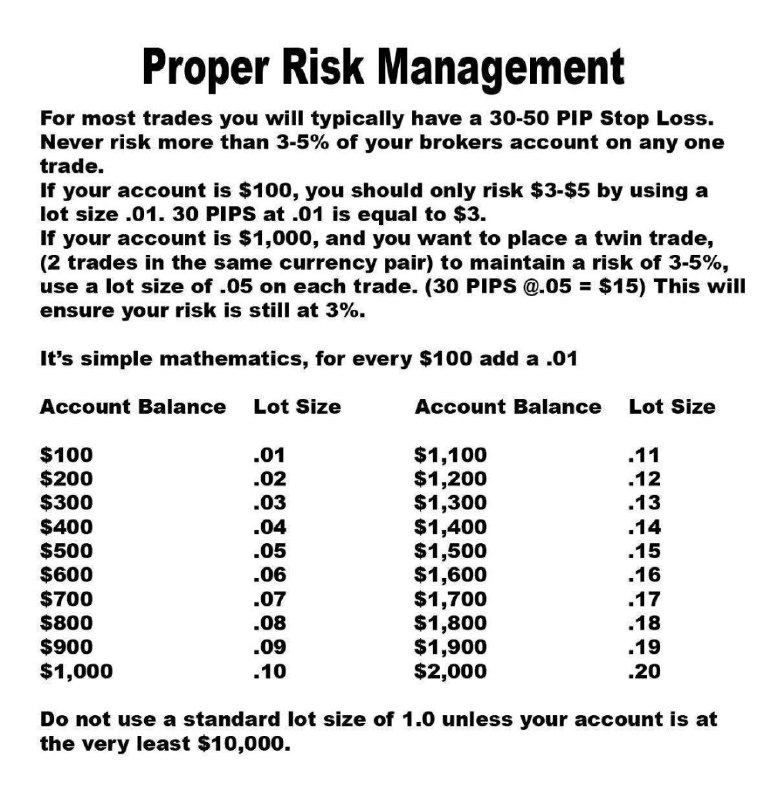

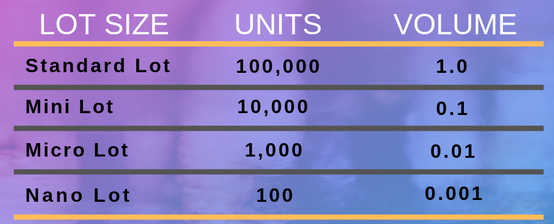

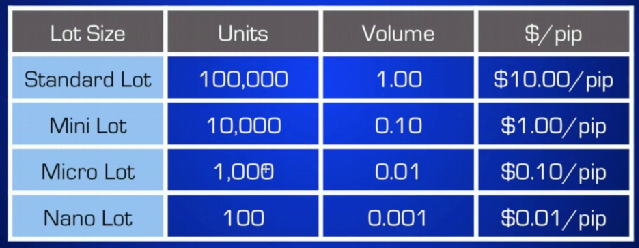

What Is a Lot?

Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units. Again, a standard lot represents 100,000 units of any currency, whereas a mini-lot represents 10,000, and a micro-lot represents 1,000 units of any currency. A one-pip movement for a standard lot corresponds with a $10 change. For example, if you buy $100,000 against the Japanese yen at a rate of ¥110.00 and the exchange rate moves to ¥110.50, which is a 50 pip movement, you have made $500. Conversely, if the exchange rate falls 50 pips to ¥109.50 your net profit and loss is minus $500.

Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units. Again, a standard lot represents 100,000 units of any currency, whereas a mini-lot represents 10,000, and a micro-lot represents 1,000 units of any currency. A one-pip movement for a standard lot corresponds with a $10 change. For example, if you buy $100,000 against the Japanese yen at a rate of ¥110.00 and the exchange rate moves to ¥110.50, which is a 50 pip movement, you have made $500. Conversely, if the exchange rate falls 50 pips to ¥109.50 your net profit and loss is minus $500.

FE

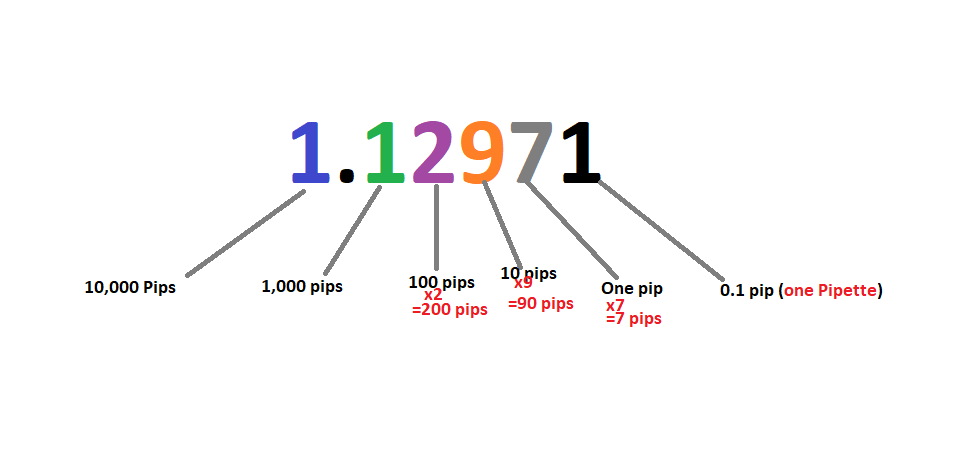

What Is a Pip?

A pip, short for point in percentage, represents a tiny measure of the change in a currency pair in the forex market. Pips are the most basic unit of measure in forex trading. It can be measured in terms of the quote or in terms of the underlying currency. A pip is a standardized unit and is the smallest amount by which a currency quote can change. It is usually $0.0001 for U.S.-dollar related currency pairs, which is more commonly referred to as 1/100th of 1%, or one basis point. In practical terms, a pip is one-hundredth of one percent, or the fourth decimal place (0.0001). Most currency pairs are quoted to the fourth (sometimes fifth) decimal place. A pip represents the fourth number. Even though a pip is a very small unit of measurement, forex traders are usually heavily leveraged and even a one pip difference can equate to significant profit or loss.

A pip, short for point in percentage, represents a tiny measure of the change in a currency pair in the forex market. Pips are the most basic unit of measure in forex trading. It can be measured in terms of the quote or in terms of the underlying currency. A pip is a standardized unit and is the smallest amount by which a currency quote can change. It is usually $0.0001 for U.S.-dollar related currency pairs, which is more commonly referred to as 1/100th of 1%, or one basis point. In practical terms, a pip is one-hundredth of one percent, or the fourth decimal place (0.0001). Most currency pairs are quoted to the fourth (sometimes fifth) decimal place. A pip represents the fourth number. Even though a pip is a very small unit of measurement, forex traders are usually heavily leveraged and even a one pip difference can equate to significant profit or loss.

FE

What Are The Forex Market Sessions?

The forex market can be broken up into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. The international currency market isn't dominated by a single market exchange but involves a global network of exchanges and brokers around the world. Forex trading hours are based on when trading is open in each participating country. Each session is 9 hours long. According to Central Daylight Time (CDT), here are the times for the Forex Market Sessions:

The forex market can be broken up into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. The international currency market isn't dominated by a single market exchange but involves a global network of exchanges and brokers around the world. Forex trading hours are based on when trading is open in each participating country. Each session is 9 hours long. According to Central Daylight Time (CDT), here are the times for the Forex Market Sessions:

- New York Session (8AM to 5PM)

- Sydney Session (5PM to 2AM)

- Tokyo Session (7PM to 4AM)

- London Session (3AM to 12PM)

FE

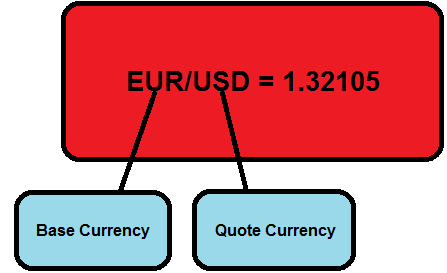

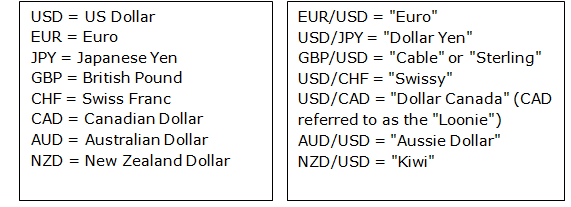

What Is a Currency Pair?

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. The first listed currency of a currency pair is called the base currency, and the second currency is called the quote currency. The EUR/USD currency pair is considered the most liquid currency pair in the world. The USD/JPY is the second most popular currency pair in the world.

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. The first listed currency of a currency pair is called the base currency, and the second currency is called the quote currency. The EUR/USD currency pair is considered the most liquid currency pair in the world. The USD/JPY is the second most popular currency pair in the world.

FE

What Is an Account Currency?

Account currency is simply the currency the brokerage account is recorded in. For example, as a forex trader, my account cash value is in USD. Typically, you open an account, deposit money denominated in your home country currency, and then buy and sell currency pairs. All your profits and losses will be converted into that particular currency.

Account currency is simply the currency the brokerage account is recorded in. For example, as a forex trader, my account cash value is in USD. Typically, you open an account, deposit money denominated in your home country currency, and then buy and sell currency pairs. All your profits and losses will be converted into that particular currency.

FE

What Is an Expert Advisor?

In the world of foreign exchange (forex) trading, an expert advisor (EA) is a piece of software that tells you when to make trades or even automatically initiates and executes trades according to preprogrammed instructions. Expert advisors are most often deployed on the MetaTrader 4 or 5 forex trading platforms. You can use an existing EA or create your own based on the trading parameters you like. These EAs are written in a programming language called MetaQuotes Language (MQL). Both MetaTrader and MQL were developed by MetaQuotes Software Corp.

In the world of foreign exchange (forex) trading, an expert advisor (EA) is a piece of software that tells you when to make trades or even automatically initiates and executes trades according to preprogrammed instructions. Expert advisors are most often deployed on the MetaTrader 4 or 5 forex trading platforms. You can use an existing EA or create your own based on the trading parameters you like. These EAs are written in a programming language called MetaQuotes Language (MQL). Both MetaTrader and MQL were developed by MetaQuotes Software Corp.

FE

What Is a Fractional Pip?

Fractional pips, known as "pipettes", exist to allow for tighter spreads. A fractional pip is equivalent to 1/10 of a pip, making it possible to view the EUR/USD currency pair with pipettes to five decimal places, while currency pairs with the yen as the quote currency to three decimal places.

Fractional pips, known as "pipettes", exist to allow for tighter spreads. A fractional pip is equivalent to 1/10 of a pip, making it possible to view the EUR/USD currency pair with pipettes to five decimal places, while currency pairs with the yen as the quote currency to three decimal places.

FE

What Is Pip Value?

In foreign exchange (forex) trading, pip value can be a confusing topic. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. For example, if the EUR/USD moves from 1.1015 to 1.1016, that's a one pip movement. Most brokers provide fractional pip pricing, so you'll also see a fifth decimal place such as in 1.10165, where the 5 is equal to five-tenths of a pip, or five pipettes. How much of a profit or loss a pip of movement produces depends on both the currency pair you are trading and the currency you funded your trading account with. Pip value matters because it affects risk. If you don't know what the pip value is, you can't precisely calculate the ideal position size for a trade and you may end up risking too much or too little on a trade.

The most heavily traded currency pairs in the world involve the U.S. dollar (USD). When USD is listed second in a pair, pip values are fixed and don't change if you have an account funded with U.S. dollars. The fixed pip amounts are: USD$10 for a standard lot, which is 100,000 units of currency. USD$1 for a mini lot, which is 10,000 units of currency. USD$0.10 for a micro lot, which is 1,000 units of currency. These pip values apply to any pair where the USD is listed second, such as the euro/U.S. dollar (EUR/USD), British pound/U.S. dollar (GBP/USD), Australian dollar/U.S. dollar (AUD/USD), and New Zealand dollar/ U.S. dollar (NZD/USD).

In foreign exchange (forex) trading, pip value can be a confusing topic. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. For example, if the EUR/USD moves from 1.1015 to 1.1016, that's a one pip movement. Most brokers provide fractional pip pricing, so you'll also see a fifth decimal place such as in 1.10165, where the 5 is equal to five-tenths of a pip, or five pipettes. How much of a profit or loss a pip of movement produces depends on both the currency pair you are trading and the currency you funded your trading account with. Pip value matters because it affects risk. If you don't know what the pip value is, you can't precisely calculate the ideal position size for a trade and you may end up risking too much or too little on a trade.

The most heavily traded currency pairs in the world involve the U.S. dollar (USD). When USD is listed second in a pair, pip values are fixed and don't change if you have an account funded with U.S. dollars. The fixed pip amounts are: USD$10 for a standard lot, which is 100,000 units of currency. USD$1 for a mini lot, which is 10,000 units of currency. USD$0.10 for a micro lot, which is 1,000 units of currency. These pip values apply to any pair where the USD is listed second, such as the euro/U.S. dollar (EUR/USD), British pound/U.S. dollar (GBP/USD), Australian dollar/U.S. dollar (AUD/USD), and New Zealand dollar/ U.S. dollar (NZD/USD).

FE

What Is Cross Rate?

A cross rate is the currency exchange rate between two currencies (cross pair) when neither are the official currencies of the country in which the exchange rate quote is given. In practice, a cross rate (cross pair) is usually a currency pair that doesn't involve the U.S. dollar.

A cross rate is the currency exchange rate between two currencies (cross pair) when neither are the official currencies of the country in which the exchange rate quote is given. In practice, a cross rate (cross pair) is usually a currency pair that doesn't involve the U.S. dollar.

FE

What Are The Major Forex Pairs?

The four major currency pairs are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These four major pairs are deliverable currencies and are part of the g10 currency group. While these currencies do a significant amount of volume related to economic transactions, they are some of the most heavily traded pairs in the world, along with the commodity currency pairs: USD/CAD, AUD/USD, and NZD/USD. The EUR/USD is by far the most heavily traded currency pair in the world and is popular among speculators due to its large daily volume.

The four major currency pairs are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These four major pairs are deliverable currencies and are part of the g10 currency group. While these currencies do a significant amount of volume related to economic transactions, they are some of the most heavily traded pairs in the world, along with the commodity currency pairs: USD/CAD, AUD/USD, and NZD/USD. The EUR/USD is by far the most heavily traded currency pair in the world and is popular among speculators due to its large daily volume.

FE

Can You Trade Options In The Forex Market?

Yes! Forex options trade over-the-counter (OTC), and traders can choose prices and expiration dates which suit their hedging or profit strategy needs. Unlike futures, where the trader must fulfill the terms of the contract, options traders do not have that obligation at expiration. These options vary widely from one product to another depending on which entity is offering the option. Because of the risk of loss when writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection. Forex options come in two varieties, so-called vanilla options and SPOT options. SPOT options are binary in nature and pay out (or not) depending on the final condition of the option.

Yes! Forex options trade over-the-counter (OTC), and traders can choose prices and expiration dates which suit their hedging or profit strategy needs. Unlike futures, where the trader must fulfill the terms of the contract, options traders do not have that obligation at expiration. These options vary widely from one product to another depending on which entity is offering the option. Because of the risk of loss when writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection. Forex options come in two varieties, so-called vanilla options and SPOT options. SPOT options are binary in nature and pay out (or not) depending on the final condition of the option.

FE

What Is Single Payment Options Trading (SPOT)?

Single payment options trading (SPOT) is a type of option product that not only lets investors request that certain conditions be met in order to receive desired payouts, but also gives investors the opportunity to govern the size of payouts they wish to receive if said conditions are met. The broker providing SPOT products will determine the likelihood that the conditions will be met and charge commissions accordingly. This type of arrangement is often referred to as a "binary option" because only the following two types of payouts are possible for the investor: The conditions set out by both parties come to fruition, and the investor collects the agreed-upon payout amount. Or, the event does not occur as planned, and the investor loses the full premium paid to the broker. SPOT is most commonly found in Forex markets.

Single payment options trading (SPOT) is a type of option product that not only lets investors request that certain conditions be met in order to receive desired payouts, but also gives investors the opportunity to govern the size of payouts they wish to receive if said conditions are met. The broker providing SPOT products will determine the likelihood that the conditions will be met and charge commissions accordingly. This type of arrangement is often referred to as a "binary option" because only the following two types of payouts are possible for the investor: The conditions set out by both parties come to fruition, and the investor collects the agreed-upon payout amount. Or, the event does not occur as planned, and the investor loses the full premium paid to the broker. SPOT is most commonly found in Forex markets.

FE

What Is a Quote?

A forex quote is the price of one currency in terms of another currency. These quotes always involve currency pairs because you are buying one currency by selling another. For example, the price of one Euro may cost $1.1404 when viewing the EUR/USD currency pair.

A forex quote is the price of one currency in terms of another currency. These quotes always involve currency pairs because you are buying one currency by selling another. For example, the price of one Euro may cost $1.1404 when viewing the EUR/USD currency pair.

FE

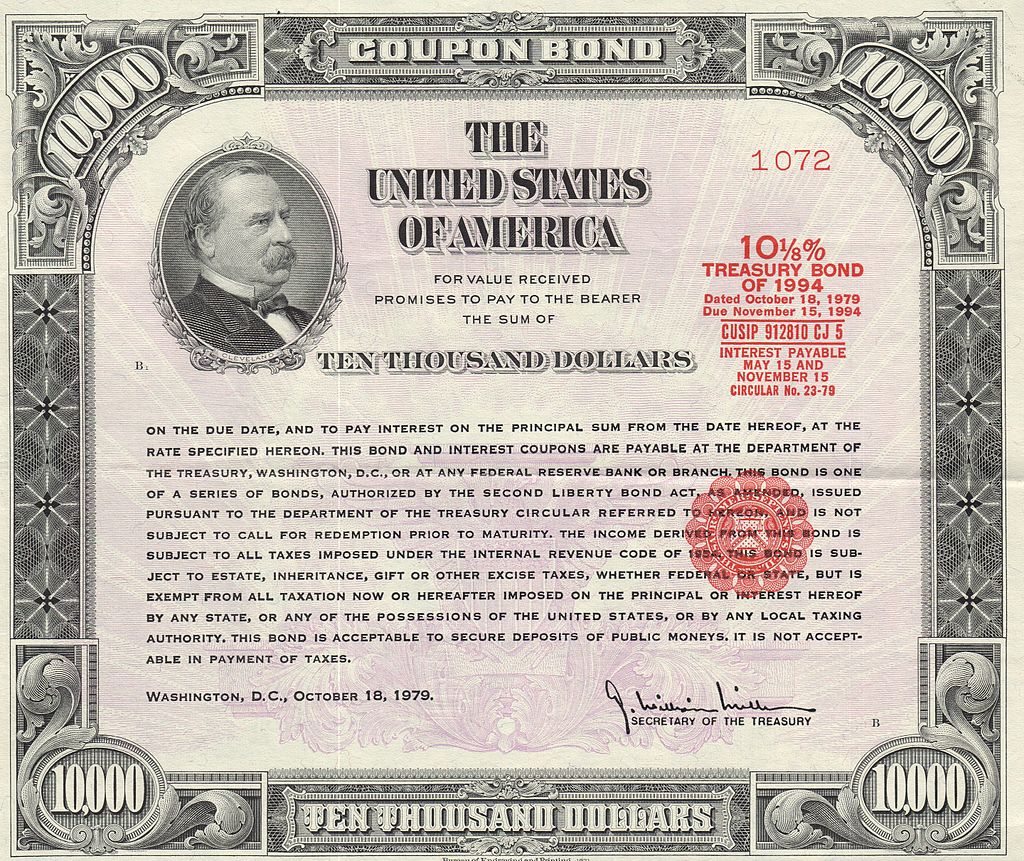

What Is a Bond?

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer. Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually includes the terms for variable or fixed interest payments made by the borrower.

Once again bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year. There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year. The second way to profit from bonds is to sell them at a price that's higher than what you pay initially.

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer. Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually includes the terms for variable or fixed interest payments made by the borrower.

Once again bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year. There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year. The second way to profit from bonds is to sell them at a price that's higher than what you pay initially.

BO

What Is a Treasury Bond?

A Treasury bond (T-bond) is a government debt security issued by the federal government that earns interest until maturity, at which point the owner is also paid a par amount equal to the principal. United States Treasury securities are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Treasury securities are often referred to simply as Treasurys.

A Treasury bond (T-bond) is a government debt security issued by the federal government that earns interest until maturity, at which point the owner is also paid a par amount equal to the principal. United States Treasury securities are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Treasury securities are often referred to simply as Treasurys.

BO

What Is a Savings Bond?

A U.S. savings bond is a government bond that offers a fixed rate of interest over a fixed period of time. Many people find these bonds attractive because they are not subject to state or local income taxes. These bonds cannot easily be transferred and are non-negotiable.

When the government sells bonds, it is in effect taking a loan from the public, which it promises to pay back at some predetermined date in the future. As compensation for providing it with capital, the government makes interest payments to its bondholders.

A U.S. savings bond is a government bond that offers a fixed rate of interest over a fixed period of time. Many people find these bonds attractive because they are not subject to state or local income taxes. These bonds cannot easily be transferred and are non-negotiable.

When the government sells bonds, it is in effect taking a loan from the public, which it promises to pay back at some predetermined date in the future. As compensation for providing it with capital, the government makes interest payments to its bondholders.

BO

What Are TIPS?

Treasury Inflation-Protected Security (TIPS) is a Treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money. The principal value of TIPS rises as inflation rises. Inflation is the pace at which prices increase throughout the U.S. economy as measured by the Consumer Price Index or CPI. Inflation becomes an issue when when there isn't a commensurate rise in real wage growth to offset the negative effects of rising prices. TIPS are issued with maturities of five, 10, and 30 years and are considered a low-risk investment because the U.S. government backs them. The principal amount is protected since investors will never receive less than the originally invested principal. You can buy Treasury Inflation-Protected Securities (TIPS) directly from the U.S. Treasury or through a bank, broker, or dealer.

Treasury Inflation-Protected Security (TIPS) is a Treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money. The principal value of TIPS rises as inflation rises. Inflation is the pace at which prices increase throughout the U.S. economy as measured by the Consumer Price Index or CPI. Inflation becomes an issue when when there isn't a commensurate rise in real wage growth to offset the negative effects of rising prices. TIPS are issued with maturities of five, 10, and 30 years and are considered a low-risk investment because the U.S. government backs them. The principal amount is protected since investors will never receive less than the originally invested principal. You can buy Treasury Inflation-Protected Securities (TIPS) directly from the U.S. Treasury or through a bank, broker, or dealer.

BO

What Are The Differences Between Bonds, Notes, And Bills?

Technically, bills, notes, and bonds are all bonds. They are all backed by the full faith and credit of the U.S. government. They are all issued electronically (you don’t get a fancy piece of paper as you do with savings bonds). They can all be purchased either directly from the Treasury or through a broker.

The major difference among them is the time you need to wait to collect your principal:

Treasury bills have maturities of a year or less.

Treasury notes are issued with maturities from two to ten years.

Treasury bonds are long-term investments that have maturities of 10 to 30 years from their issue date.

The bills, like savings bonds, are sold at a discount from their face value. You get the full amount when the bill matures. The notes and bonds, on the other hand, are sold at their face value, have a fixed interest rate, and kick off interest payments once every six months. The minimum denomination for all three is $1,000, and you can buy them all in any increment of $1,000.

Technically, bills, notes, and bonds are all bonds. They are all backed by the full faith and credit of the U.S. government. They are all issued electronically (you don’t get a fancy piece of paper as you do with savings bonds). They can all be purchased either directly from the Treasury or through a broker.

The major difference among them is the time you need to wait to collect your principal:

Treasury bills have maturities of a year or less.

Treasury notes are issued with maturities from two to ten years.

Treasury bonds are long-term investments that have maturities of 10 to 30 years from their issue date.

The bills, like savings bonds, are sold at a discount from their face value. You get the full amount when the bill matures. The notes and bonds, on the other hand, are sold at their face value, have a fixed interest rate, and kick off interest payments once every six months. The minimum denomination for all three is $1,000, and you can buy them all in any increment of $1,000.

BO

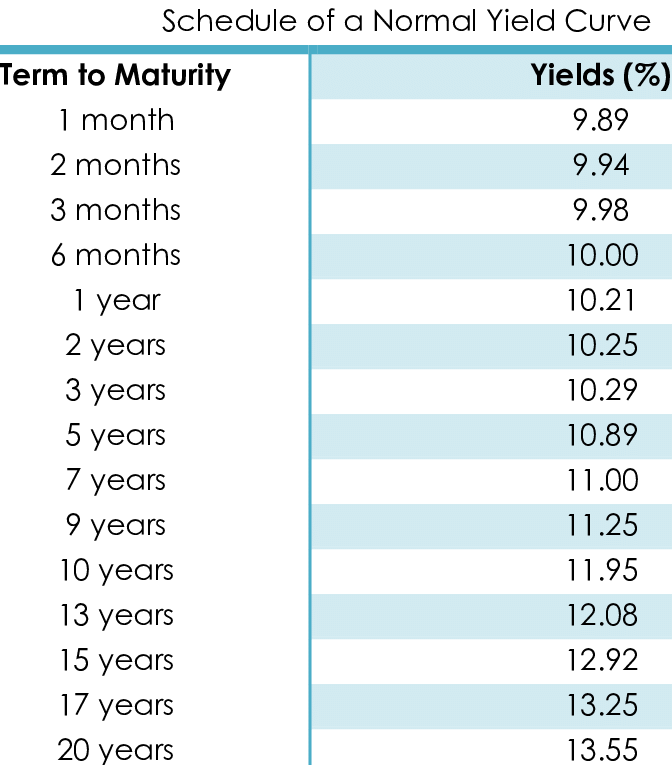

What Is Term to Maturity?

A bond's term to maturity is the length of time during which the owner will receive interest payments on the investment. When the bond reaches maturity the principal is repaid. When the bond reaches maturity, the owner is repaid its par, or face, value. Also, the further a bond is from its maturity date, the larger the difference between its purchase price and its redemption value, which is also referred to as its principal, par, or face value.

A bond's term to maturity is the length of time during which the owner will receive interest payments on the investment. When the bond reaches maturity the principal is repaid. When the bond reaches maturity, the owner is repaid its par, or face, value. Also, the further a bond is from its maturity date, the larger the difference between its purchase price and its redemption value, which is also referred to as its principal, par, or face value.

BO

BO

What Is Maturity Date?

The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. On this date, which is generally printed on the certificate of the instrument in question, the principal investment is repaid to the investor, while the interest payments that were regularly paid out during the life of the bond, cease to roll in. The maturity date also refers to the termination date (due date) on which an installment loan must be paid back in full.

The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. On this date, which is generally printed on the certificate of the instrument in question, the principal investment is repaid to the investor, while the interest payments that were regularly paid out during the life of the bond, cease to roll in. The maturity date also refers to the termination date (due date) on which an installment loan must be paid back in full.

BO

What Are The Risks Of Investing In a Bond?

As an investor, you should be aware of some of the pitfalls that come with investing in the bond market. Although bonds are considered safe, there are pitfalls like interest rate risk — one of the primary risks associated with the bond market. Reinvestment risk means a bond or future cash flows will need to be reinvested in a security with a lower yield. Default risk occurs when the issuer can't pay the interest or principal in a timely manner or at all. Inflation risk occurs when the rate of price increases in the economy deteriorates the returns associated with the bond.

As an investor, you should be aware of some of the pitfalls that come with investing in the bond market. Although bonds are considered safe, there are pitfalls like interest rate risk — one of the primary risks associated with the bond market. Reinvestment risk means a bond or future cash flows will need to be reinvested in a security with a lower yield. Default risk occurs when the issuer can't pay the interest or principal in a timely manner or at all. Inflation risk occurs when the rate of price increases in the economy deteriorates the returns associated with the bond.

BO

What Is a Corporate Bond?

Corporate bonds are bonds issued by companies that want to raise additional cash. You can buy corporate bonds on the primary market through a brokerage firm, bank, bond trader, or a broker.

Corporate bonds are bonds issued by companies that want to raise additional cash. You can buy corporate bonds on the primary market through a brokerage firm, bank, bond trader, or a broker.

BO

What Is a Municipal Bond?

A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures, including the construction of highways, bridges or schools. Municipal bonds are exempt from federal taxes and most state and local taxes, making them especially attractive to people in high income tax brackets.

A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures, including the construction of highways, bridges or schools. Municipal bonds are exempt from federal taxes and most state and local taxes, making them especially attractive to people in high income tax brackets.

BO

What Is Cryptocurrency?

A cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets.

A cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets.

CC

What Is Bitcoin?

Bitcoin is a cryptocurrency. It is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Bitcoin is a cryptocurrency. It is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

CC

What Is a Cryptocurrency Wallet?

A cryptocurrency wallet is a device, physical medium, program or a service which stores the public and/or private keys and can be used to track ownership, receive or spend cryptocurrencies. The cryptocurrency itself is not in the wallet. The wallet stores private and public keys, which are necessary to send and receive coins. There are hardware, software and paper wallets. Hardware and paper wallets are typically considered more secure than software wallets, although there are pros and cons associated with each. If you lose your private key and can’t access your wallet through back-up methods, you will never be able to recover your coins and they are effectively removed from circulation.

A cryptocurrency wallet is a device, physical medium, program or a service which stores the public and/or private keys and can be used to track ownership, receive or spend cryptocurrencies. The cryptocurrency itself is not in the wallet. The wallet stores private and public keys, which are necessary to send and receive coins. There are hardware, software and paper wallets. Hardware and paper wallets are typically considered more secure than software wallets, although there are pros and cons associated with each. If you lose your private key and can’t access your wallet through back-up methods, you will never be able to recover your coins and they are effectively removed from circulation.

CC

What Is a Smart Contract?

A smart contract is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract. It is an agreement that is written in computer code and automatically executes when certain conditions are met. Some networks, most notably Ethereum, support smart contracts while others do not. Smart contracts allow the performance of credible transactions without third parties. These transactions are trackable and irreversible.

A smart contract is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract. It is an agreement that is written in computer code and automatically executes when certain conditions are met. Some networks, most notably Ethereum, support smart contracts while others do not. Smart contracts allow the performance of credible transactions without third parties. These transactions are trackable and irreversible.

CC

What Is an Initial Coin Offering (ICO)?

An ICO, also known as a token sale, is a means of crowdfunding where a company offers a new coin in exchange for fiat currency (U.S. dollars for example) or a digital currency (Bitcoin, Ether, Litecoin, etc.) Typically, the funds they received are used to develop the new concept, and the token they issued will be used to transact on their network once it is launched. Both China and South Korea have banned ICOs, and the SEC has stated that they could be considered the offer and sale of securities depending on the circumstances of the offering.

An ICO, also known as a token sale, is a means of crowdfunding where a company offers a new coin in exchange for fiat currency (U.S. dollars for example) or a digital currency (Bitcoin, Ether, Litecoin, etc.) Typically, the funds they received are used to develop the new concept, and the token they issued will be used to transact on their network once it is launched. Both China and South Korea have banned ICOs, and the SEC has stated that they could be considered the offer and sale of securities depending on the circumstances of the offering.

CC

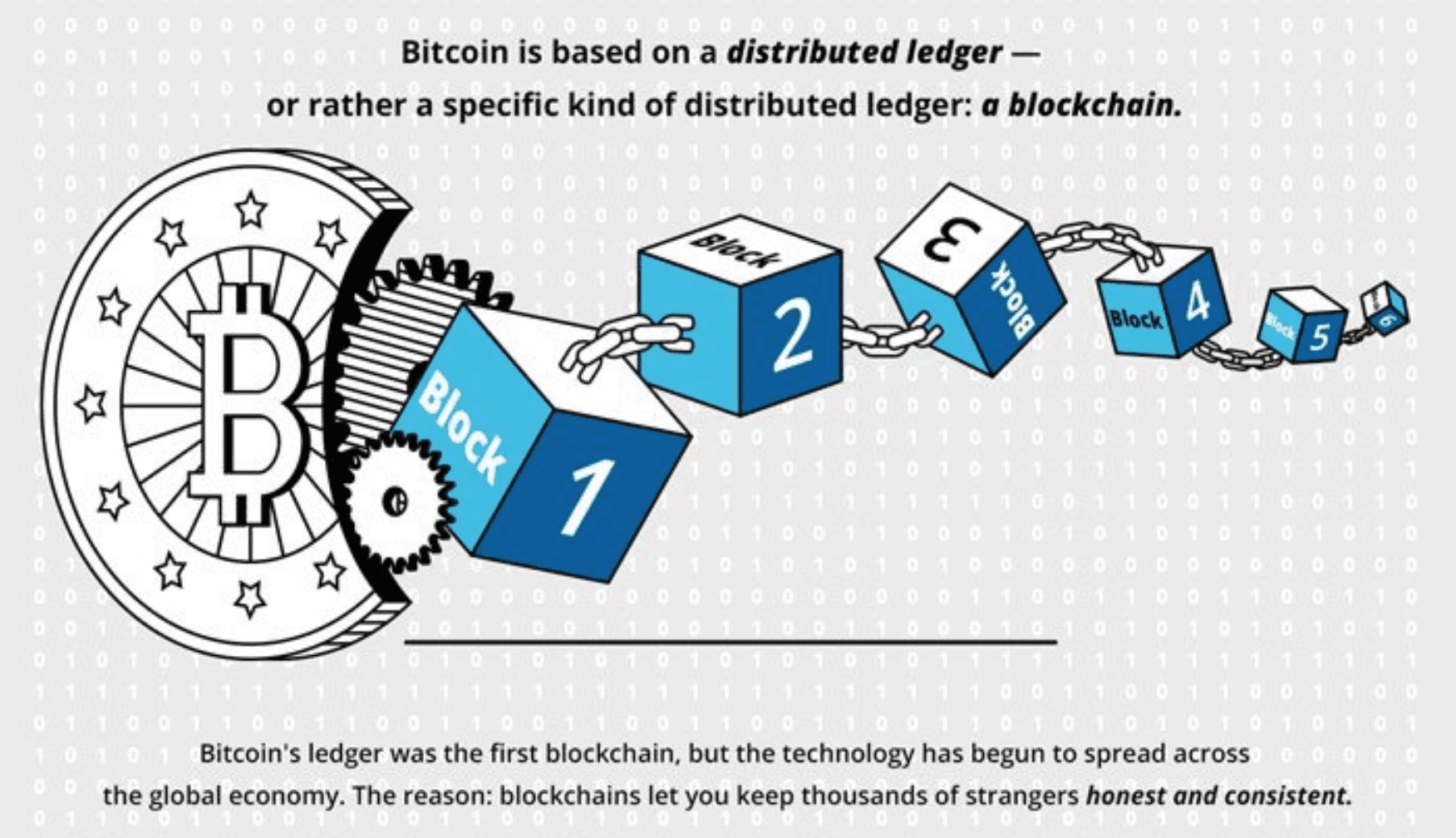

What Is a Blockchain?

At its most basic level, blockchain is literally just a chain of blocks, but not in the traditional sense of those words. When we say the words “block” and “chain” in this context, we are actually talking about digital information (the “block”) stored in a public database (the “chain”). “Blocks” on the blockchain are made up of digital pieces of information. Blocks store information about transactions like the date, time, and dollar amount of your most recent purchase from Amazon. They store information about who is participating in transactions, and they also store information that distinguishes them from other blocks.

At its most basic level, blockchain is literally just a chain of blocks, but not in the traditional sense of those words. When we say the words “block” and “chain” in this context, we are actually talking about digital information (the “block”) stored in a public database (the “chain”). “Blocks” on the blockchain are made up of digital pieces of information. Blocks store information about transactions like the date, time, and dollar amount of your most recent purchase from Amazon. They store information about who is participating in transactions, and they also store information that distinguishes them from other blocks.

CC

What Is Hodl?

Hodl is slang in the cryptocurrency community for holding the cryptocurrency rather than selling it. A person who does this is known as a Hodler. It originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject, "I AM HODLING."

Hodl is slang in the cryptocurrency community for holding the cryptocurrency rather than selling it. A person who does this is known as a Hodler. It originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject, "I AM HODLING."

CC

What Is a Fork?

A fork in a blockchain can occur in any crypto-technology platform. You may think of the blocks in blockchains as cryptographic keys that move memory. Because the miners in a blockchain set the rules that move the memory in the network, these miners understand the new rules. However, all of the miners need to agree about the new rules and about what comprises a valid block in the chain. So when you want to change those rules you need to "fork it"—like a fork in a road—to indicate that there's been a change in or a diversion to the protocol. The developers can then update all of the software to reflect the new rules.

It is through this forking process that various digital currencies with names similar to bitcoin have come to be: bitcoin cash, bitcoin gold, and others. For the casual cryptocurrency investor, it can be difficult to tell the difference between these cryptocurrencies and to map the various forks onto a timeline.

A fork in a blockchain can occur in any crypto-technology platform. You may think of the blocks in blockchains as cryptographic keys that move memory. Because the miners in a blockchain set the rules that move the memory in the network, these miners understand the new rules. However, all of the miners need to agree about the new rules and about what comprises a valid block in the chain. So when you want to change those rules you need to "fork it"—like a fork in a road—to indicate that there's been a change in or a diversion to the protocol. The developers can then update all of the software to reflect the new rules.

It is through this forking process that various digital currencies with names similar to bitcoin have come to be: bitcoin cash, bitcoin gold, and others. For the casual cryptocurrency investor, it can be difficult to tell the difference between these cryptocurrencies and to map the various forks onto a timeline.

CC

What Is a Cryptocurrency Address?

A Bitcoin address is a unique identifier that serves as a virtual location where the cryptocurrency can be sent. People can send the cryptocurrency to Bitcoin addresses similarly to the way fiat currencies can often be sent to email addresses. However, the Bitcoin address is not intended to be permanent, but just a token for use in a single transaction. Unlike a digital wallet, a Bitcoin address cannot hold a balance. The address itself consists of 26-35 alphanumeric characters. This string is the public half of an asymmetric key pair. The standard format for a Bitcoin address is P2PKH (pay to public key hash).

A Bitcoin address is a unique identifier that serves as a virtual location where the cryptocurrency can be sent. People can send the cryptocurrency to Bitcoin addresses similarly to the way fiat currencies can often be sent to email addresses. However, the Bitcoin address is not intended to be permanent, but just a token for use in a single transaction. Unlike a digital wallet, a Bitcoin address cannot hold a balance. The address itself consists of 26-35 alphanumeric characters. This string is the public half of an asymmetric key pair. The standard format for a Bitcoin address is P2PKH (pay to public key hash).

CC

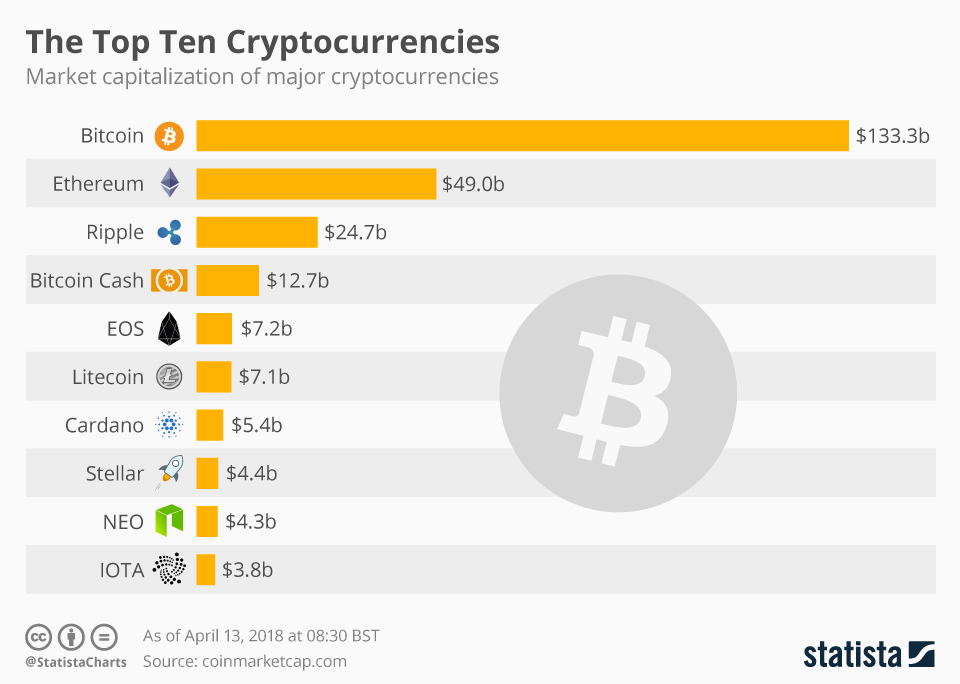

What Is an Altcoin?

Altcoins are the other cryptocurrencies launched after the success of Bitcoin. Generally, they sell themselves as better alternatives to Bitcoin. The term "altcoins" refers to all cryptocurrencies other than Bitcoin. As of early 2020, there were more than 5,000 cryptocurrencies by some estimates. According to CoinMarketCap, altcoins accounted for over 34% of the total cryptocurrency market in February 2020.

Altcoins are the other cryptocurrencies launched after the success of Bitcoin. Generally, they sell themselves as better alternatives to Bitcoin. The term "altcoins" refers to all cryptocurrencies other than Bitcoin. As of early 2020, there were more than 5,000 cryptocurrencies by some estimates. According to CoinMarketCap, altcoins accounted for over 34% of the total cryptocurrency market in February 2020.

CC

What Is a Hardware Cryptocurrency Wallet?

A hardware wallet is a special type of bitcoin wallet which stores the user's private keys in a secure hardware device. They have major advantages over standard software wallets: private keys are often stored in a protected area of a microcontroller, and cannot be transferred out of the device in plaintext.

A hardware wallet is a special type of bitcoin wallet which stores the user's private keys in a secure hardware device. They have major advantages over standard software wallets: private keys are often stored in a protected area of a microcontroller, and cannot be transferred out of the device in plaintext.

CC

BP: Immense Upside Potential Even If Dividends Are Temporarily Suspended

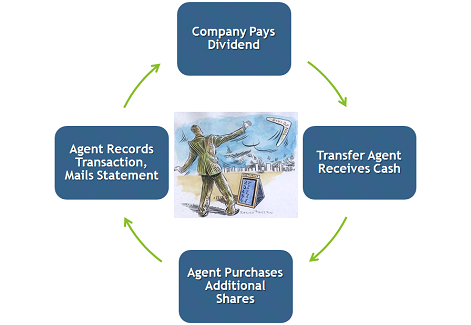

What Are Dividend Aristocrats?

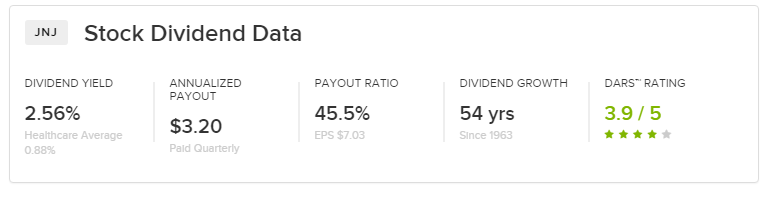

A Dividend Aristocrat is a company in the S&P 500 that has paid and increased its base dividend every year for at least 25 consecutive years. S&P Dow Jones Indices, which owns the S&P 500 index, reviews the list of qualifying companies every year and updates the list of companies that carry Dividend Aristocrat status. Their impressive track records of dividend growth make Dividend Aristocrats some of the most attractive dividend stocks to own.

A Dividend Aristocrat is a company in the S&P 500 that has paid and increased its base dividend every year for at least 25 consecutive years. S&P Dow Jones Indices, which owns the S&P 500 index, reviews the list of qualifying companies every year and updates the list of companies that carry Dividend Aristocrat status. Their impressive track records of dividend growth make Dividend Aristocrats some of the most attractive dividend stocks to own.

DI

What Is Trading?

Trading involves more frequent transactions, such as the buying and selling of stocks, commodities, currency pairs, or other instruments. While investors may be content with annual returns of 10% to 15%, traders might seek a 10% return each month. Trading involves short-term strategies to maximize returns daily, monthly, or quarterly. The goal is to generate returns that outperform buy-and-hold investing. Long term investors are more likely to ride out short-term losses, while traders will attempt to make transactions that can help them profit quickly from fluctuating markets.

Trading involves more frequent transactions, such as the buying and selling of stocks, commodities, currency pairs, or other instruments. While investors may be content with annual returns of 10% to 15%, traders might seek a 10% return each month. Trading involves short-term strategies to maximize returns daily, monthly, or quarterly. The goal is to generate returns that outperform buy-and-hold investing. Long term investors are more likely to ride out short-term losses, while traders will attempt to make transactions that can help them profit quickly from fluctuating markets.

TR

What Are The Types of Traders?

A trader's style refers to the timeframe or holding period in which stocks, commodities, or other trading instruments are bought and sold. Traders generally fall into one of four categories:

Position Trader: Positions are held from months to years.

Swing Trader: Positions are held from days to weeks.

Day Trader: Positions are held throughout the day only with no overnight positions.

Scalp Trader: Positions are held for seconds to minutes with no overnight positions.

A trader's style refers to the timeframe or holding period in which stocks, commodities, or other trading instruments are bought and sold. Traders generally fall into one of four categories:

Position Trader: Positions are held from months to years.

Swing Trader: Positions are held from days to weeks.

Day Trader: Positions are held throughout the day only with no overnight positions.

Scalp Trader: Positions are held for seconds to minutes with no overnight positions.

TR

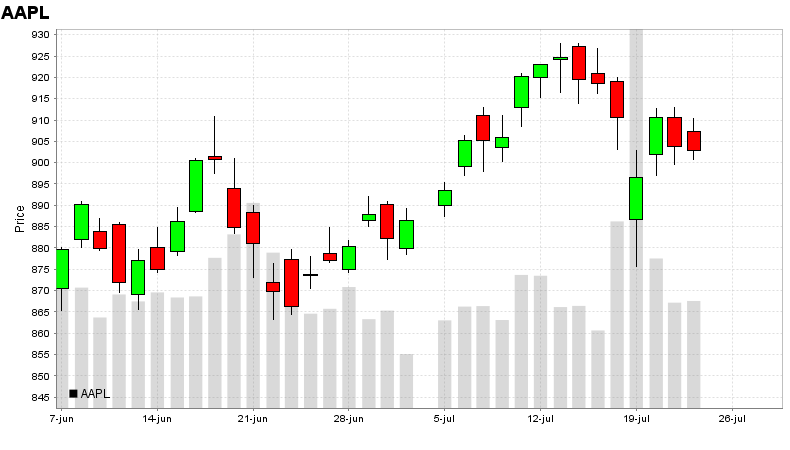

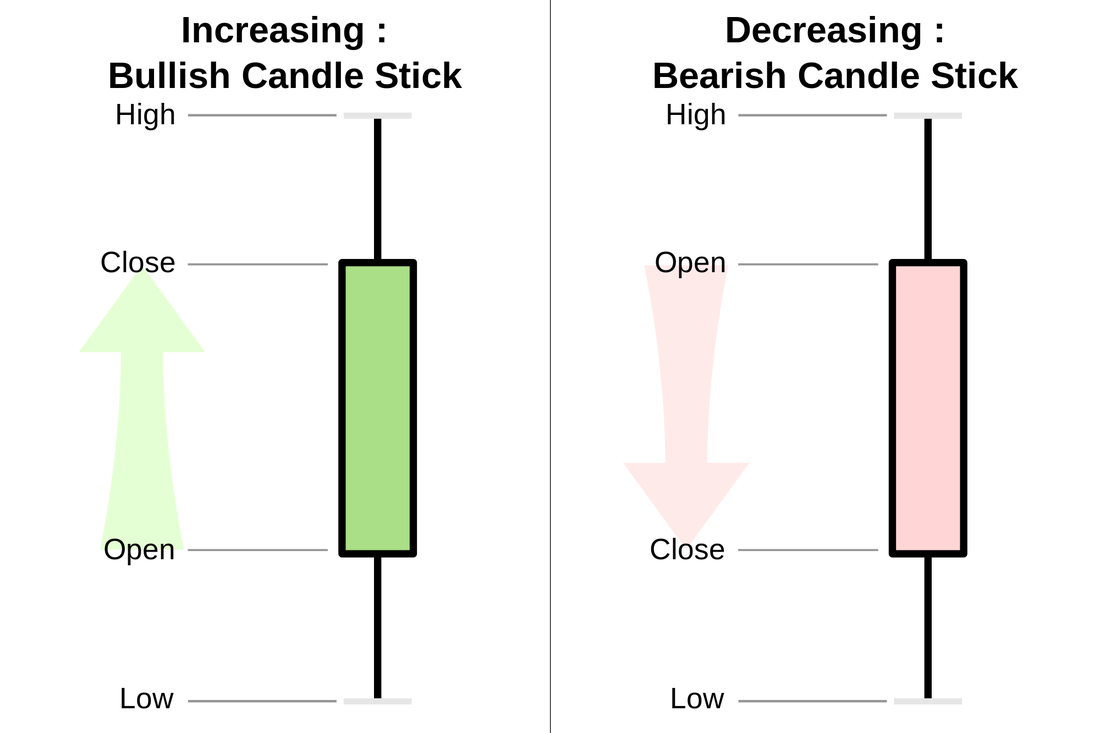

What Is Support & Resistance (S&R)?

Resistance: price level where an up trend can be expected to pause due to sell off in the stock. When the stock supply and demand hit equilibrium, the price stops rising... thus forming resistance.

Support: price level where a down trend can be expected to pause due to a concentration of demand. As the stock drops, demand increases. When it hits equilibrium, the price stops dropping... thus forming support.

Resistance: price level where an up trend can be expected to pause due to sell off in the stock. When the stock supply and demand hit equilibrium, the price stops rising... thus forming resistance.

Support: price level where a down trend can be expected to pause due to a concentration of demand. As the stock drops, demand increases. When it hits equilibrium, the price stops dropping... thus forming support.

TR

What Is the Bid Ask Spread?

The bid–ask spread, is the difference between the prices quoted for an immediate sale and an immediate purchase for stocks, futures contracts, options, or currency pairs. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost.

The bid–ask spread, is the difference between the prices quoted for an immediate sale and an immediate purchase for stocks, futures contracts, options, or currency pairs. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost.

TR

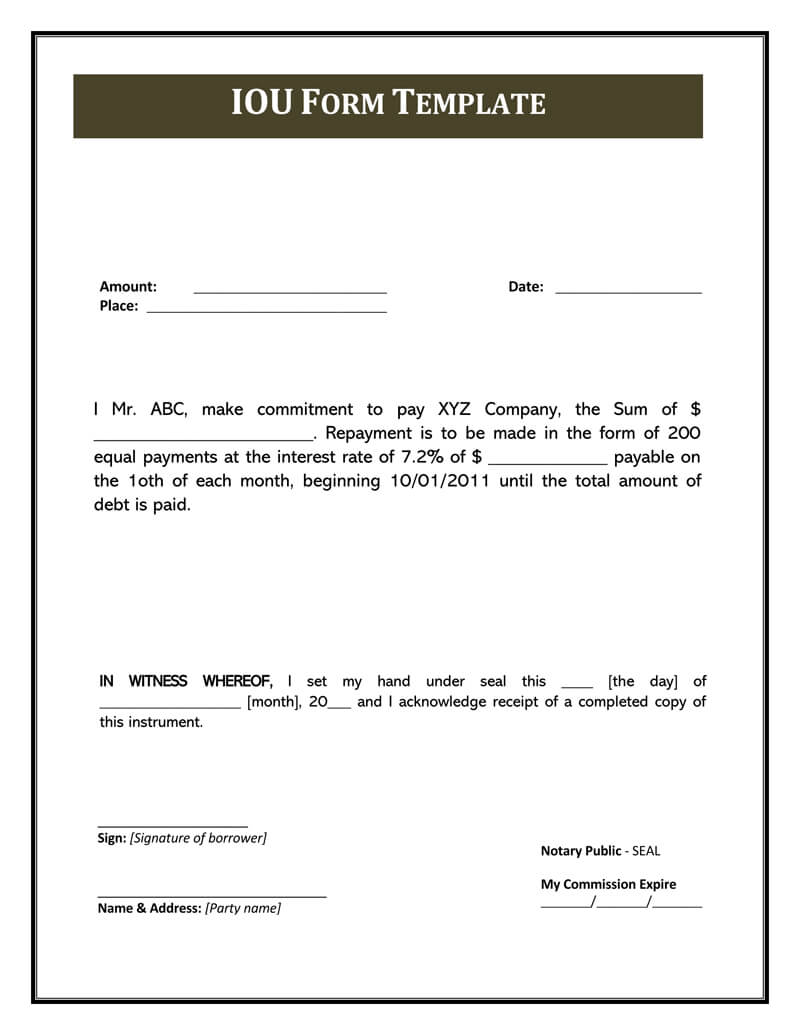

What Is an IOU?

An IOU is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor. IOU meaning I Owe You.

An IOU is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor. IOU meaning I Owe You.

FI

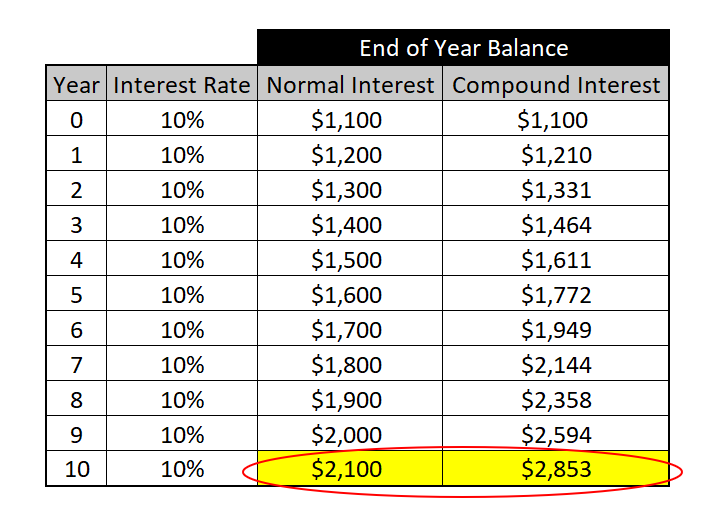

What Is Compound Interest?

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

FI

What Are Futures?

Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. Here, the buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date. Underlying assets include physical commodities or other financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used for hedging or trade speculation.

Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. Here, the buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date. Underlying assets include physical commodities or other financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used for hedging or trade speculation.

FU

What Are Stock (Market) Futures?

Stock market futures, also called market futures or equity index futures, are futures contracts that track a specific benchmark index like the S&P 500. While commodity futures require delivery of the underlying goods (IE: corn, sugar, crude oil), market futures contracts get settled with cash or get rolled over. Market futures allow traders to trade the direction of the underlying equity index, hedge equity positions and be used as a lead indicator for the markets and stocks. Unlike options that can expire worthless when out of the money, expiring market futures are rolled over into the next expiration month contract. Market futures contracts expire on the third Friday of each quarterly month, starting from March. Expiring contracts are rolled over to the next expiration month on the second Thursday of the week.

Stock market futures, also called market futures or equity index futures, are futures contracts that track a specific benchmark index like the S&P 500. While commodity futures require delivery of the underlying goods (IE: corn, sugar, crude oil), market futures contracts get settled with cash or get rolled over. Market futures allow traders to trade the direction of the underlying equity index, hedge equity positions and be used as a lead indicator for the markets and stocks. Unlike options that can expire worthless when out of the money, expiring market futures are rolled over into the next expiration month contract. Market futures contracts expire on the third Friday of each quarterly month, starting from March. Expiring contracts are rolled over to the next expiration month on the second Thursday of the week.

FU

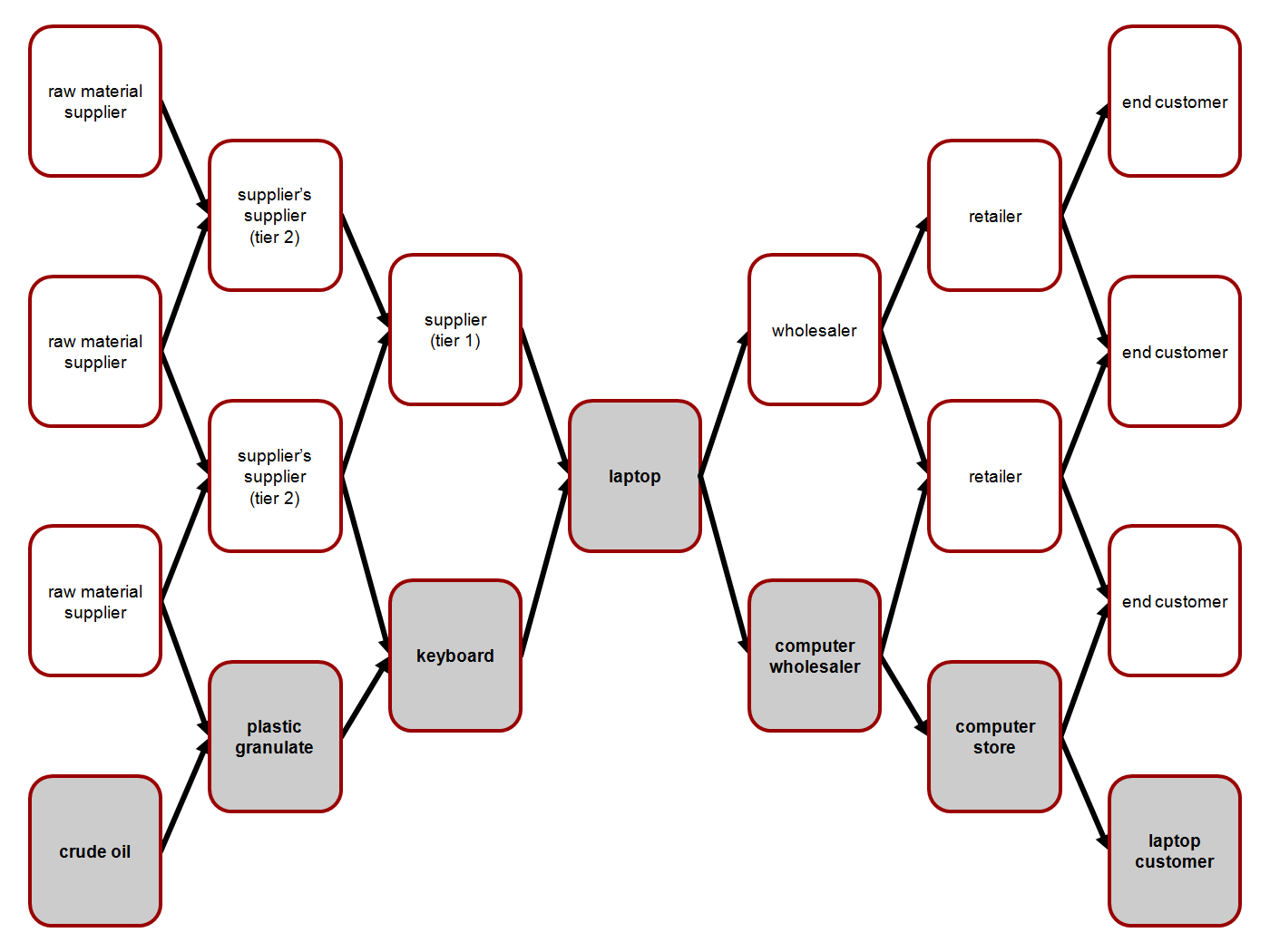

What Is a Commodity?

A commodity is a basic good used in commerce that is interchangeable with other commodities of the same type. It is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee. Commodities are most often used as inputs in the production of other goods or services. Investors and traders can buy and sell commodities directly in the spot (cash) market or via derivatives such as futures and options. Owning commodities in a broader portfolio is encouraged as a diversifier and a hedge against inflation.

A commodity is a basic good used in commerce that is interchangeable with other commodities of the same type. It is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee. Commodities are most often used as inputs in the production of other goods or services. Investors and traders can buy and sell commodities directly in the spot (cash) market or via derivatives such as futures and options. Owning commodities in a broader portfolio is encouraged as a diversifier and a hedge against inflation.

FU

What Is a Delivery Date?

A delivery date is the final date by which the underlying commodity for a futures or forward contract must be delivered for the terms of the contract to be fulfilled. Most futures contracts are used as a hedge to reduce the risk of adverse price movements in a commodity and are closed out with an offsetting position (selling to offset a long position and buying to offset a short position) before the actual delivery date.

A delivery date is the final date by which the underlying commodity for a futures or forward contract must be delivered for the terms of the contract to be fulfilled. Most futures contracts are used as a hedge to reduce the risk of adverse price movements in a commodity and are closed out with an offsetting position (selling to offset a long position and buying to offset a short position) before the actual delivery date.

FU

What Is a Forward Contract?

Unlike standard futures contracts, a forward contract can be customized to a commodity, amount and delivery date. Commodities traded can be grains, precious metals, natural gas, oil, or even poultry. A forward contract settlement can occur on a cash or delivery basis. Forward contracts do not trade on a centralized exchange and are therefore regarded as over-the-counter (OTC) instruments. While their OTC nature makes it easier to customize terms, the lack of a centralized clearinghouse also gives rise to a higher degree of default risk. As a result, forward contracts are not as easily available to the retail investor as futures contracts.

Unlike standard futures contracts, a forward contract can be customized to a commodity, amount and delivery date. Commodities traded can be grains, precious metals, natural gas, oil, or even poultry. A forward contract settlement can occur on a cash or delivery basis. Forward contracts do not trade on a centralized exchange and are therefore regarded as over-the-counter (OTC) instruments. While their OTC nature makes it easier to customize terms, the lack of a centralized clearinghouse also gives rise to a higher degree of default risk. As a result, forward contracts are not as easily available to the retail investor as futures contracts.

FU

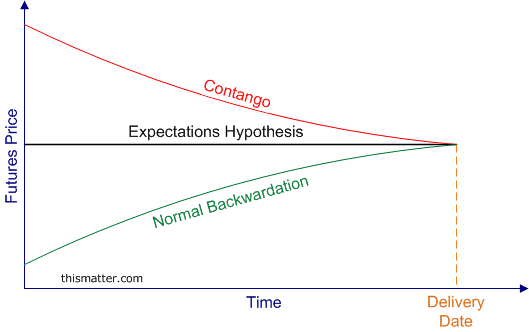

What Is Backwardation?

Backwardation is when the current price of an underlying asset is higher than prices trading in the futures market. Backwardation can occur as a result of a higher demand for an asset currently than the contracts maturing in the coming months through the futures market. Traders use backwardation to make a profit by selling short at the current price and buy at the lower futures price. Backwardation is sometimes confused with an inverted futures curve. In essence, a futures market expects higher prices at longer maturities and lower prices as you move closer to the present day when you converge at the present spot price.

Backwardation is when the current price of an underlying asset is higher than prices trading in the futures market. Backwardation can occur as a result of a higher demand for an asset currently than the contracts maturing in the coming months through the futures market. Traders use backwardation to make a profit by selling short at the current price and buy at the lower futures price. Backwardation is sometimes confused with an inverted futures curve. In essence, a futures market expects higher prices at longer maturities and lower prices as you move closer to the present day when you converge at the present spot price.

FU

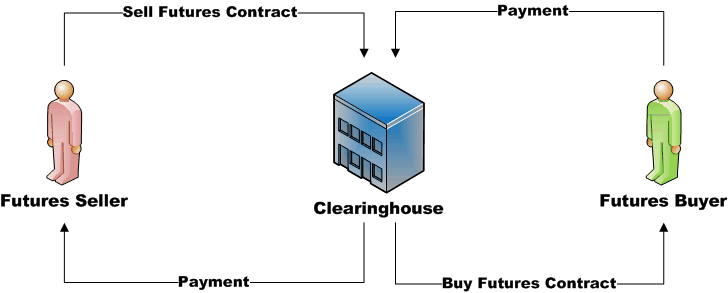

What Is a Clearinghouse?

Clearing houses provide clearing and settlement services for futures traded at an exchange. They act as the neutral counterparty between every buyer and seller, ensuring the soundness and integrity of every trade. Clearing is a fundamental benefit in the futures markets. Long before a trade is cleared through a clearing house, clearing firms check the financial strength of both parties to the trade, whether they’re a big institution or an individual trader.

They also provide access to trading platforms, where the buyer and seller agree on the price, quantity and maturity of the contract. Then, when the contract is cleared by matching these offsetting (one buy, one sell) positions together, the clearing house guarantees that both buyer and seller get paid. This offsetting or “netting” process takes risk out of the financial system as a whole.

Clearing houses provide clearing and settlement services for futures traded at an exchange. They act as the neutral counterparty between every buyer and seller, ensuring the soundness and integrity of every trade. Clearing is a fundamental benefit in the futures markets. Long before a trade is cleared through a clearing house, clearing firms check the financial strength of both parties to the trade, whether they’re a big institution or an individual trader.

They also provide access to trading platforms, where the buyer and seller agree on the price, quantity and maturity of the contract. Then, when the contract is cleared by matching these offsetting (one buy, one sell) positions together, the clearing house guarantees that both buyer and seller get paid. This offsetting or “netting” process takes risk out of the financial system as a whole.

FU

What Is Contango?